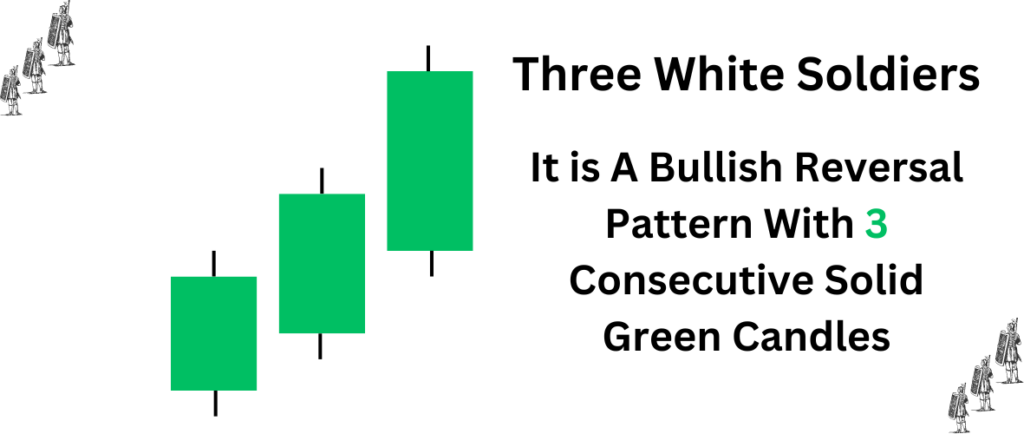

The three white soldiers are one of the most recognizable and reliable bullish reversal patterns in technical analysis. It signals a potential trend change from down to up after three consecutive long-bodied candlesticks close higher than the previous candle’s real body.

Traders who understand the nuances of this pattern can capitalize on the momentum shift it often predicts. In this article, we will cover the mechanics of the three white soldiers pattern, provide examples of how it forms, discuss trading strategies, and address some risks and considerations for using it.

By the end, you should have a solid grasp of how to identify this bullish reversal and trade it profitably. Let’s get started!

What is the Three White Soldiers Pattern?

The three white soldiers pattern forms after a downtrend and consists of three long-bodied candlesticks that close higher than the previous candle within the same trading period. Each candle opens anywhere but closes at or near the high.

It consists of three bullish or white candles in a row as they close higher than their real bodies. These are called white candles because the real body is white/hollow and the shadows are black. The open is anywhere but the close is always near the high making each real body long and strong.

It forms after a downtrend looking to reverse the trend from bearish to bullish. Volume is usually higher on the third candle confirming the strength and momentum behind the bullish reversal. A gap-up opening on the first candle adds more confirmation of a trend reversal. However, it’s not a requirement for the pattern to form.

In summary, three long, strong bullish candles closing consecutively higher indicates buyers are taking control of the market and a short-term bottom may be in place.

How to Trade the Three White Soldiers Pattern

Now that we understand what qualifies as a three-white soldiers pattern, let’s discuss strategies for trading it:

Entry:

- Wait for the close of the third candle, as this completes the pattern. Enter long on the next daily candle open or pullback.

- Set a protective stop-loss just below the low of the pattern’s range bounded by the start of the first candle and the end of the third. For the Visa example, the stop would be below $205.

- Consider adding to the position on intraday dips or pullbacks within an upward trending channel after the entry if risk/reward looks favorable. Scale in to average down.

Exit/Target:

- Take partial profits as the stock moves in your favor to lock in gains and remove initial risk. Trail the stop-up as the trend develops.

- The initial upside target is a 38.2-50% Fibonacci retracement of the prior downtrend’s range, for Visa, which came out to around $230 initially.

- Further targets can be 1-2x the pattern’s height or multiples of the average true range depending on momentum. Strong bull trends may run significantly past targets.

- Move the stop to breakeven or slightly above entry as the trade limits downside risk. Consider selling off the position in thirds or quarters on the way up.

Alternate Strategies:

- Buy call options on a stock displaying the pattern for leveraged upside. Sell or roll calls up as targets are reached.

- Trade ETFs or indexes that are trending in sync with the instrument displaying the pattern for broader market exposure.

- Enter small initially and scale in more on additional retracements or pattern failures for lower risk averaging.

The key is waiting for pattern confirmation, setting risk controls, scaling decisions, and managing trades with stops and targets. Patience is important to filter reliable signals.

Understanding Volume and Other Confirmations

Volume is an especially important consideration in the three white soldiers’ pattern. For it to be a reliable reversal signal, volume typically builds on the third candle:

- Increasing volume validates growing buyer participation and confirmation of the bullish reversal. It shows sellers are being overwhelmed.

- If the volume is decreasing or flat across the three candles, it indicates weaker confirmation, and buyers may not have full control yet. The pattern is less reliable.

- Spikes in volume dramatically higher than average on candle three often precede strong trend extensions as capitulation selling ends.

Other factors that add confidence to the three white soldiers include:

- Gaps higher between the candles, especially the first, which leave sellers behind.

- Prior downtrend duration – longer periods increase the reliability of reversals.

- The increase in the number of candles in real body size shows that buyers are gaining more control each session.

- Positive momentum indicators like MACD forming bullish divergences across the lows.

- Support test at a significant level like a moving average.

The more coinciding evidence, the less likelihood of a fakeout or failed reversal. Volume is a must, while other factors raise the statistical chances of success.

Managing Risks with the Three White Soldiers

As with any pattern, there are risks to be aware of when trading the three white soldiers:

- Momentum may fade quickly if the prior downtrend was sharp, leaving buyers exhausted. Confirmation is key.

- A failure swap lower on the next candle breaks the pattern, invalidating the signal. Close stops are mandatory.

- Unexpected negative news can trigger more sellers. Only enter when fundamentals align.

- Gaps down on the open violate the pattern, as it represents weakness continuing.

- Lower timeframe divergences at pattern completion may foreshadow weakness.

- Extended three-day runs up can be due for a pullback, so scaling in helps.

- Triple tops/bottoms are risks if resistance is met again after the pattern.

To manage risks:

- Set tight stop losses and scale out of partial positions on moves against you.

- Only enter high probability patterns, waiting for volume spikes on candle three.

- Consider patterns on higher time frames like the weekly/monthly for stronger signals.

- Beware of unexpected news events that spook markets around reversal areas.

- Watch for failure swaps and divergences as patterns complete before positions are sized.

With risk controls and patience, the three white soldiers remain one of the more reliable bullish reversal patterns. Managing position sizing is important given the inherent uncertainties.

Conclusion

In summary, the three white soldiers are a straightforward yet effective bullish reversal pattern for technical traders. By understanding its mechanics, supporting factors, entry/exit strategies, and risks, you can consistently identify and capitalize on the short-term trend changes it often predicts.

With the right risk management and patience in waiting for confirmation, it provides an edge versus the passive buy-and-hold approach. Continue to backtest it across markets over time to internalize results.

Always consider fundamentals and technical convergences too when screening for high-probability setups. Most importantly, start with small share sizes and scale strategically to keep risk defined on each trade.

Mastering proven patterns like the three white soldiers is a practical approach any trader can adopt to profit from shifts in market psychology. Follow these guidelines and you’ll be well on your way to tapping into the opportunities it surfaces.