As a precious metal and industrial commodity, silver offers traders exposure to macroeconomic trends as well as supply and demand dynamics within specific industries. Characterized by periods of high volatility, silver markets present both risks and rewards for skilled technical and fundamental analysts. This guide covers the basics of silver trading, and ETF trading strategies while analyzing the drivers of silver prices. A forecast to trade silver in 2024 rounds out the article.

Supply and Demand Basics

Silver demand stems primarily from industrial applications like electronics, batteries, and solar panels which account for over half of consumption. Photography and jewelry make up most remaining uses. On the supply side, around 80% of mined silver derives as a byproduct of base metals, coal, lead, and zinc production. Both mining output and industrial demand fluctuate based on global economic conditions and technology cycles. Traders can watch these key indicators to predict where the price might move.

How To Choose A Trading Platform?

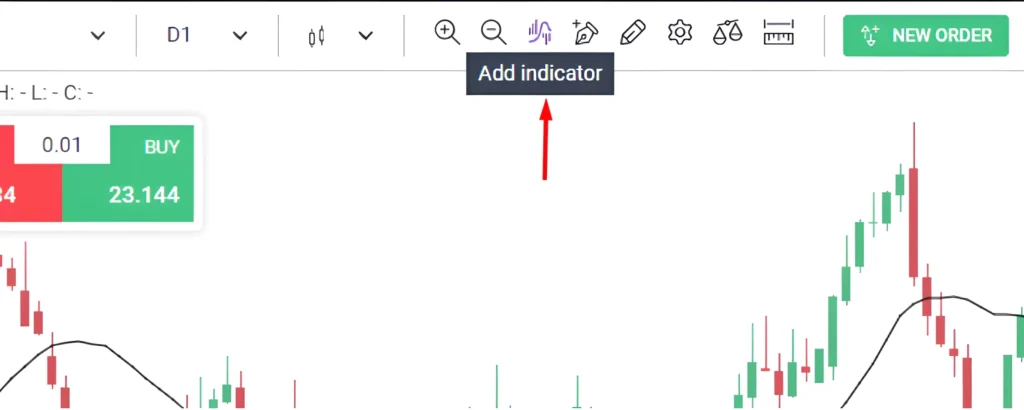

When getting into any type of trading you must pick a trading platform that can help you get the results you want. Allpips for example offers its traders a simple and easy-to-use interface. Even if the interface seems simple it is filled with all the tools and indicators you need while trading.

Allpips also provides its users with educational resources to help improve their trading strategies. Along with that traders are offered around-the-clock support if they ever encounter an issue. Trading with the right platform that fits your needs can come a long way when embarking on the world of trading.

Technical Analysis Tools

Technical analysis utilizes various tools and indicators to identify trading opportunities in the silver market. Chart patterns, trend lines, and moving averages are among the most basic yet important tools for technical traders.

Chart patterns like head and shoulders and triangles form recognizable patterns that can signal reversals or continuation of trends. Trend lines connect significant highs and lows to identify the prevailing direction of price movement.

Moving averages smooth out price data by calculating average closing prices over a specific number of periods. Common periods include 50, 100, and 200 periods. Moving averages help identify trends as well as possible support and resistance levels. Crossovers between short and long-term moving averages generate buy and sell signals.

Oscillators measure momentum and show when assets may be overbought or oversold. The Relative Strength Index (RSI) indicates this on a 0-100 scale. Divergences between RSI and price can identify reversal opportunities. All these indicators can be easily accessed on the Allpips Trading platform.

Fundamental Catalysts

Traders estimate the impacts of macroeconomic surprises, central bank policy shifts, geopolitical tensions, and industry disruptions on silver markets. Economic data releases from major economies influence near-term demand expectations. Comments from FOMC or ECB meetings guide interest rate outlooks affecting silver’s appeal as an inflation hedge. Supply deficits or surpluses shift market structures.

Exchange Traded Products

For a cost-efficient way to gain long or short exposure without using leverage, traders utilize silver ETFs like SLV tracking actual spot prices. Smaller funds like DSLV offer leveraged bullish exposure as well. Traders monitor ETF flows to gauge institutional sentiment shifts. Options sometimes trade on SLV providing hedging or directional plays.

Managing Risks in Volatile Markets

Regardless bullish long-term outlook, risks persist in the near term like volatility around macroeconomic data or geopolitical events. Traders use only 2-5% leverage per position and avoid leveraging long-term forecast assumptions. Set protective stops to minimize losses if views prove incorrect. Re-evaluate strategies regularly based on evolving market conditions rather than reacting emotionally to fluctuations. These opportunities are best grasped through patience and disciplined analysis.

Silver Price Forecast 2024

Silver has had a volatile yet mostly range-bound year in 2023, trading between $20-26 per ounce. As we head into 2024, various supply, demand, and macroeconomic factors could point to a stronger year ahead for silver prices. This article analyzes the key drivers that may push Silver higher next year, including expected interest rate cuts, industrial demand trends, and technical factors. A price target of $30 per ounce is presented based on a confluence of supportive influences potentially taking hold in 2024.

2023 Market Review

Silver spent 2023 trapped in a broad triangle pattern, lacking a clear directional bias for much of the year. Rising Treasury yields kept a lid on gains for precious metals into the fall. Silver also faced resistance of around $26 after multiple failed breakout attempts. Meanwhile, the gold/silver ratio remained rangebound after wild swings provided trading opportunities but no sustained trend. Support near 78.5 and resistance at 88 will be key levels to watch going forward.

Forecast To Trade Silver in 2024

Considering the following factors – expected interest rate cuts, firming industrial usage, supply constraints, technical signs of life, and persistent geopolitical influencers – a conclusion can be made that 2024 could mark a breakout year for silver prices. If it can sustain a move above the $26 level, the next significant resistance target is $30 per ounce. Downside risks include slower global growth undercutting demand or renewed USD strength from higher rates. But $30-handle appears within reach for silver in a year that may align many stars in its favor.

Conclusion | How To Trade Silver in 2024

Using a well-thought-out strategy that combines technical, fundamental, and macro analysis to trade silver in 2024, can help strategic traders profit from recurring opportunities in the silver markets. Even if there are risks associated with exposures, using tried-and-true techniques reduces downturns while taking part in expected bull markets. Ongoing education also enhances your ability to handle this precious metal, which has historically been a profitable but volatile asset.