When researching and studying the forex market and the many strategies it beholds, the term ” scalping ” may have appeared many times. Scalping in forex is very popular among traders. Many have made profits from scalping and its different strategies. Scalping is a strategy that you must learn as a forex trader. This article will help you understand what is forex scalping, how you can use it, and when to avoid it.

What is Forex Scalping?

Scalping in forex is derived from the meaning of scalping (skimming). When you hear the word scalping, you probably picture something being gradually scraped off. The same in forex, scalping is about getting small profits at a time. Traders who use scalping are referred to as ” Scalpers”.

Many small profits can build up after many trades. Most scalpers make many trades in one session. Unlike other strategies that hold their position for hours, days, or even weeks, in scalping the idea is to make a trade in minutes or even seconds. Pips ( percentage in point) is the smallest exchange price movement in forex currency pairs. Scalpers usually aim for five to ten pips a trade.

How to Get Started in Forex Scalping

To first start in forex scalping you need to realize that you will need to invest time in monitoring and observing markets. That mentality needs to be developed to be able to focus more on trading.

Next, you need to pick a broker. You should pay attention to all the agreements between you and the broker. Understanding what responsibilities are on you and what the broker is responsible for. Also, be aware of how much margin is required. Research should be done before making any decisions.

Charting time frames are a must when scalping. The reasoning is you don’t have much time for in-depth analysis and need to make decisions on the go. A reliable system must be built that can be used repeatedly. Tick charts, or one- or two-minute charts are very useful charts to use.

When Should You Not Scalp?

Scalping in forex focuses strongly on liquidity and volatility. Only the currency pairs with high liquidity should be used while forex scalping. Some of these currency pairs are EUR/USD, USD/JPY, and GBP/USD. Liquidity is important as it can cause the currency value to spike up or spike down. Liquidity in many markets means stability.

Scalping in forex is intense and high-speed. With that being the nature of scalping, much focus is needed. The high intensity and speed can be fun and exciting, but it can also be very stressful and tiring. Whenever you feel unfocused or stressed you should stop and rest until clarity is present again. The reason being focused is very important is that without focus you can misjudge a trade and it can result in many losses. Stopping to trade and regrouping yourself can be very helpful. Confidence and practice are very important to consider while forex scalping.

Top Forex Scalping Indicators

The trader uses indicators to recognize various market moves. Making informed selections can be assisted by a trader’s ability to recognize and identify movements. There are various indications for each trading strategy. It is best to experiment with various indicators to see which one works best with your strategy. Some of the best indicators you might consider for scalping are the following:

1- Moving averages

Moving Average (MA) is a useful indicator. It works by calculating the average movement of a certain stock over some time. This smooths out the price data giving the average price while constantly being updated.

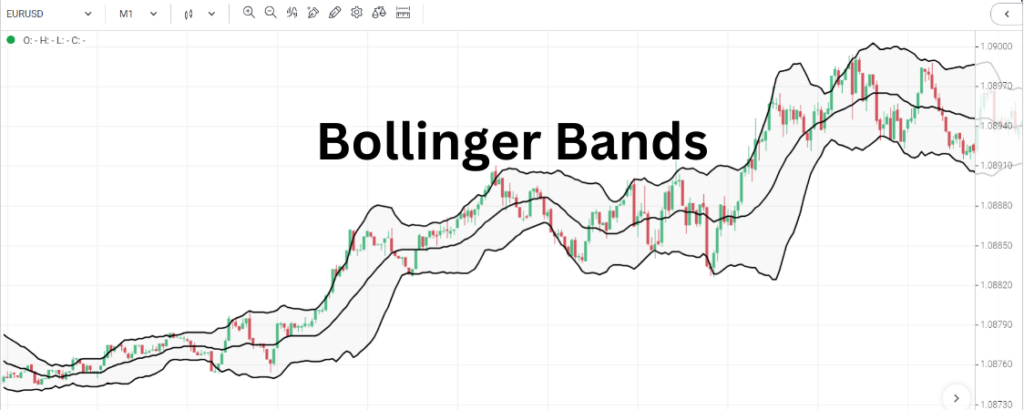

2- Bollinger Band scalping

Bollinger Bands are effective at showing the volatility of the market and indicating the entry and exit points for a trade. When the distance between the bands declines then market volatility is less, and oppositely if the distance widens then volatility is greater. All this information can be useful for a scalper while trying to decide on his next move. Check out our strategy for using Bollinger bands with RSI.

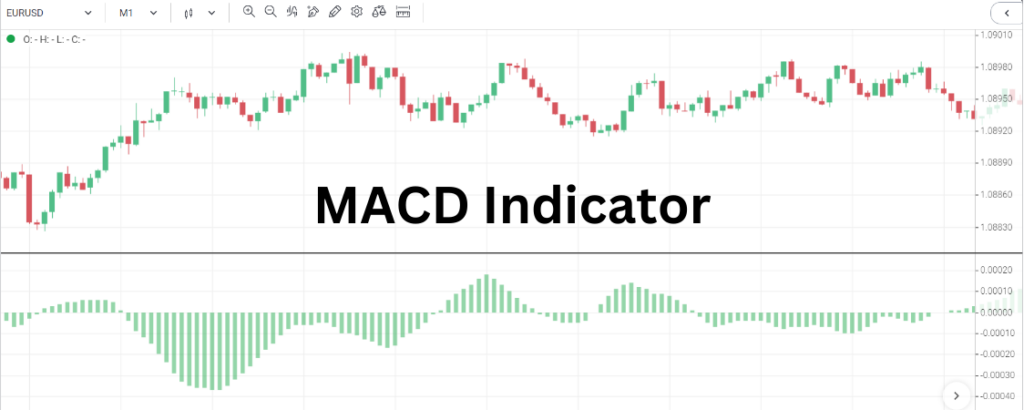

3- MACD indicator

The Moving Average Convergence Divergence (MACD) indicator is useful for forex scalping strategies. It measures the difference between two exponential moving averages to identify momentum shifts and divergence. Traders can enter a position when MACD crosses above or below the signal line, targeting quick profits from small price movements in their favor. The MACD helps scalpers spots good entry and exit points fortrades holding only minutes or hours.

Conclusion

Forex scalping is a popular trading strategy. Many scalpers have found success with this approach. The primary goal of scalping is to make quick, small earnings. Even though the exchange only takes a few seconds, they pile up over time. Scalping calls for intense concentration. Any distractions that arise could cost you money. The trader should take a breath and collect their thoughts after a string of losses.

Scalping requires the use of a dependable system that you can employ with confidence. What scalpers require is the ability to make decisions quickly and without thorough analysis. All traders should use indicators with their trading since reading charts and making trading decisions without them is difficult. Always remember to do your due diligence on a strategy before applying it to your trading, and always have proper risk management.