One of the most recognized and often traded forex trading products is the GBP/USD pair. It provides opportunities for both swing and day trading because of its strong volatility and substantial liquidity. In this article, we will take a general review of the GBPUSD pair in this session and share some important tips for profitable trading.

What is The GBP/USD Pair?

The British pound to US dollar exchange rate is represented by the significant currency pair GBP USD. Because it represents the currencies of the two biggest economies in the world—the United States and Great Britain—it is one of the most liquid and frequently traded currency pairings worldwide. The base currency is the British pound, while the quoted currency is the US dollar. To put it briefly, the GBPUSD exchange rate indicates the amount of US dollars needed to buy one British pound.

For instance, if the GBP USD is trading at 1.3000 right now, that means that one British pound is worth 1.3 US dollars. As a result, an upward movement in price on a price chart of the GBP-USD pair indicates that the value of the British pound is increasing about the US dollar. On the other hand, a downward swing in price action indicates that the British pound is losing ground against the US dollar. Stated differently, the US dollar is increasing in value to the British pound. It’s worth noting that a lot of forex traders call the Pound Dollar pair “Cable.”

The GDP, employment, inflation, and other economic reports have a significant influence on the GBPUSD pair. Nonetheless, one of the main factors influencing price direction and volatility in the GBP-USD currency pair is central bank action. This has to do with the FOMC, the Fed division in charge of setting interest rates, as well as the central bank choices made by the Bank of England. The GBP-USD pair has been trading historically since the early 1970s. Around this time, free-floating exchange rates were adopted by both the US and the UK. The two currencies were linked to the gold standard before that.

When Should You Trade The GBP/USD Pair?

A great currency pair for day trading as well as swing trading is GBP/USD. One reason is that its average daily range is wide enough to benefit from transient price fluctuations. The average daily range, or ADR, assesses the currency pair’s daily price volatility.

Additionally, the GBP/USD currency pair is extremely steady and a safe currency to trade, except for significant price jumps brought on by unanticipated news events or central bank rate announcements. Both technical and fundamental traders will find it useful. Using chart analysis, indicator analysis, or any other technical-based method, technical analysts will identify a plethora of tradeable possibilities. There are additional benefits for fundamental analysts who trade the GBP/USD pair. For this specific pair, an abundance of economic reports and scheduled press announcements are available for examination and analysis.

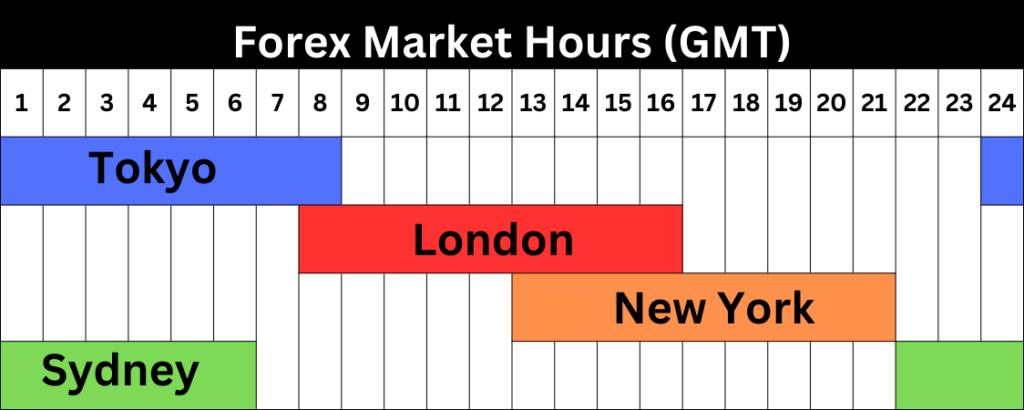

When the London and New York sessions overlap, it is the best time to trade the GBP/USD currency pair. The currency pair experiences its highest volume during this period. Within this time, the bid-ask spreads will be at their tightest, and you should normally see very little slippage on your trades.

Between 8 AM ET and 12 PM ET, is the period when the London session and the New York session overlap. The opening hour of the London session, from 3 AM ET to 4 AM ET, is the second-best period to execute trades in the GBP/USD currency pair. There is a decent amount of volume in the pair at this time because this is when the majority of European markets are trading. During this window, there is often a breakout that lasts through the New York session and the end of the day’s trading.

What Should You Look Out For When Trading The GBP/USD Pair

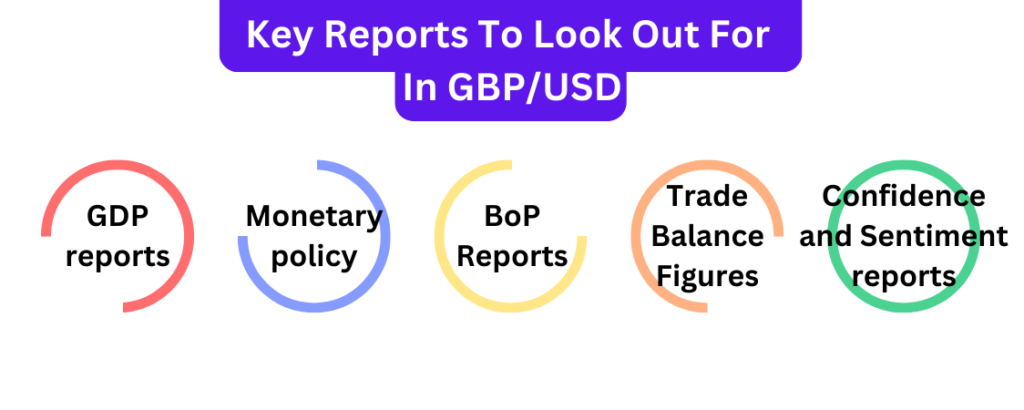

What are some of the key economic reports that traders of the GBP/USD currency pair should keep an eye out for? The volatility of the GBP/USD pair can be influenced by a lot of economic data releases, but forex traders should pay attention to the following.

The GDP reports for the United States and the United Kingdom is the first. GDP is a quarterly report that assesses how much economic activity occurred in a certain nation during a given time frame. Since the preliminary GDP figures are the first to be issued and give traders an early indication of the state of the economy, they often have the biggest impact on the price of the currency pair.

Monetary policy announcements are also something that traders on FX Cable should be aware of. Particularly remarks and judgments about interest rates made by the US Federal Reserve and the Bank of England (BOE). These crucial rate-related decisions in England are within the responsibility of the Monetary Policy Committee, or MPC. Such relevant policies are overseen by the Federal Reserve’s FOMC branch in the United States. These announcements rank among the market events with the highest volatility for the GBP/USD currency pair.

Conclusion

The high liquidity and volatility of the GBP/USD currency pair offer a wide range of opportunities for swing and intraday traders alike. With so much historical price data accessible, it makes a great pair for technical analysis. Macroeconomic events that frequently move this currency pair, such as GDP figures and US and UK central banks’ policy choices, are also profitable opportunities for fundamental traders.

Swing traders have a greater opportunity to recognize and carry out positional trades based on medium-term trends than short-term traders, who can benefit from daily volatility spikes around important reports. Whatever the approach, maximizing profits when trading GBP/USD can be achieved by effectively controlling risk through stop losses, trading during busy London/New York overlap sessions, and researching catalysts like scheduled announcements.