When thinking about to trade Bitcoin it can be a lucrative yet unpredictable endeavor. As the largest cryptocurrency, it remains one of the most volatile assets with a history of massive gains and losses. For those looking to actively trade this emerging digital asset, Allpips offers a feature-rich exchange designed with both beginners and experts in mind. This comprehensive guide will outline the steps to set up a Bitcoin trading strategy on allpips.

What Platform Should I Use To Trade Bitcoin?

When choosing an exchange to trade Bitcoin, Allpips stands out as a trusted and user-friendly option. Established in 2014, it was one of the earliest players in the crypto space and now supports over 60 digital assets. Other notable alternatives include Coinbase, Binance, and Kraken but Allpips is well-suited for both amateur and advanced traders alike with low fees, advanced charting tools, and a robust mobile app. Its simple sign-up process requires only basic identification for account verification.

How Do I Fund My Allpips Account?

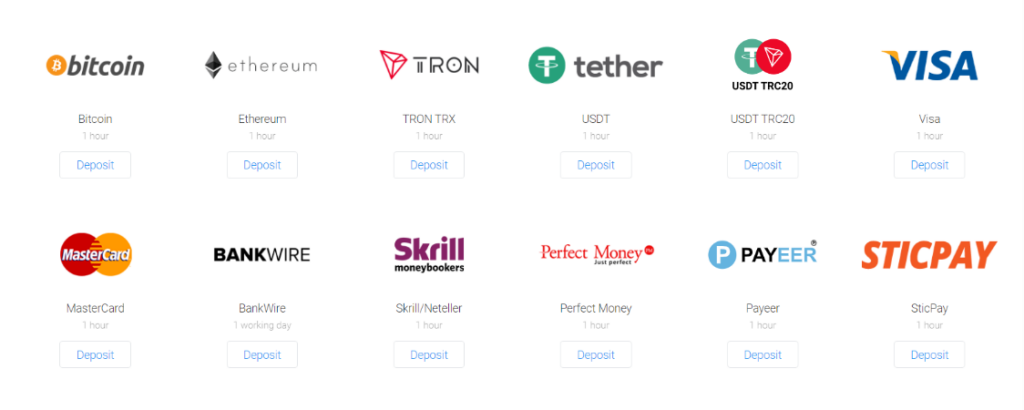

Once registered, depositing funds is straightforward. All major fiat currencies (USD, EUR, GBP, etc.) can be added through debit/credit cards or via bank wire. All other different funding options are also available such as crypto wallets, Visa, or even Perfect money. For those new to crypto, consider starting with a demo account to get familiar with placing trades before risking real money. Alternatively, depositing Bitcoin or another cryptocurrency directly incurs negligible network fees. Maintaining a cash balance provides flexibility to capitalize on emerging opportunities.

Which Bitcoin Trading Pair Should I Use?

The most liquid Bitcoin trading pair is BTC/USD given the dollar’s prominence in global finance. However, consider your personal quoting preference based on geographic location or existing currency holdings. Some additional major pairs include BTC/EUR, BTC/GBP, and BTC/JPY. For those seeking maximum trading flexibility, monitor multiple exchange rates side-by-side using Allpips integrated currency converter. Taking advantage of cross-market arbitrage opportunities is also possible for more advanced strategies.

How Do I Analyze Bitcoin’s Price Trends?

Technical analysis reigns supreme for charting Bitcoin’s erratic price behavior. Allpips supplies various timeframe options from 1 minute to 1 month plus the top technical indicators. Focus initially on 1-hour and daily bars to identify key support/resistance levels, trendlines, moving averages, Bollinger Bands, and candlestick patterns. Incorporating order flow data from major exchanges sheds further light on buy/sell momentum. Interpreting these signals through multiple lenses helps anticipate potential trend continuation or reversal setups.

What Order Types Should You Use For Entries And Exits?

Market orders deliver the swiftest possible entry but carry the risk of slippage, especially for large positions. Limit orders targeting technical price zones offer better average fill prices. For intraday directional trades, traders may opt to place stops beyond logical breakdown points. An alternative is trailed stop-loss orders to lock profits as moves extend in your favor. Setting multiple order triggers simultaneously through “if-then” statements automates strategic layers. Backtesting theoretical entries enhances order placement expertise over time.

How Should I Practice Before Actively Trading?

Promising strategies look much different on paper than in live markets. Allpips thoughtfully furnishes a powerful simulated paper trading environment to perfect skills without risk. Here, replicate your technical/fundamental analyses and true order lifetimes (opens, fills, cancels, etc) to expose weaknesses gradually against historical data. Transition strategies have proven consistently profitable on paper over multiple timeframes – repeating this iterative refinement process separates eventual success from emotional failure. Patience forms the soundest foundation for the highly speculative Bitcoin landscape.

What Risk Management Practices Are Essential?

Leverage magnifies all outcomes for better or worse, necessitating strict controls. Consider limiting positional exposure using the 2% rule – never risking more than 2% of capital on a single trade. Likewise, impose maximum daily loss thresholds to avoid tilt. Technical stop-losses set objectively are mandatory, as emotional overrides are often regretted. Dollar-cost averaging long positions over time and selling short-term momentum mitigate volatility. Overall, emphasize preserving capital through discipline above short-lived performance boasting; steady gains compound healthfully in the long run. Bitcoin’s infamously violent moves punish the underprepared.

What Tax Obligations Must I Consider?

Tax treatment of cryptocurrency profits varies globally but is quickly solidifying. In the US for example, the IRS views Bitcoin as property subject to capital gains tax – selling above cost basis within one year triggers short-term rates up to 37%, long long-term holds beyond 12 months down to 20%. Track adjusted cost values meticulously and generate official reports through allpips. Consult regional advisors annually for compliant returns if realizing six figures plus in profits. Factor potential liabilities wisely into long-term portfolio strategy rather than hastily sheltering gains abroad. Full compliance minimizes audit risk given intensifying regulation.

How Do I Securely Access My Bitcoin Funds?

Exchanges represent custodial conduits; true crypto ownership entails direct private keys. Allpips’ built-in wallet function stores deposit on decentralized public ledgers instead, but holding large positions continuously exposes it to potential hacking or exchange outages. Consider transferring long-term holdings to non-custodial “cold storage” via hardware or paper wallets secured with multiple passphrases and backups across fireproof locations. For active trading positions, utilize exchange hot wallets streamlined for quick trades as supplementary access otherwise leaves funds vulnerable if keys are lost or stolen. Multi-sig options grant further security through multi-signature authentication.

Conclusion | How to Trade Bitcoin

In summary, Allpips offers a comprehensive platform for beginners and professionals alike to partake and trade Bitcoin. By diligently mastering technicals, risk discipline, and strategic order placement – plus accounting for taxes and security best practices – informed traders can potentially achieve desirable long-term outcomes despite inherent short-term unpredictability and risk. Consistent refinement separates eventual winners.