Day trading is a high-risk strategy that involves opening and closing positions within the same trading day. By seeking to profit from short-term price fluctuations, day traders must have precise entry and exit skills as well as the ability to analyze technical indicators.

This article examines whether the highly liquid EUR/USD currency pair can be successfully day traded. As the world’s most traded currency pairing with over $650 billion in average daily turnover, EUR/USD experiences fast intraday moves that provide opportunities. However, day trading in this volatile market also comes with substantial risks.

What is Day Trading?

Day trading refers to the strategy of opening and closing currency positions within the same trading day. By holding positions for only brief periods, day traders aim to profit from short-term price fluctuations rather than long-term market trends. Successful day trading requires precision entry and exit skills coupled with the ability to read technical indicators that can signal potential intraday reversals or accelerations. While offering potentially high returns, day trading is also one of the most risky styles due to its low margin of error and constant exposure to sudden market volatility.

Is The EUR/USD Pair Well Suited For Day Trading?

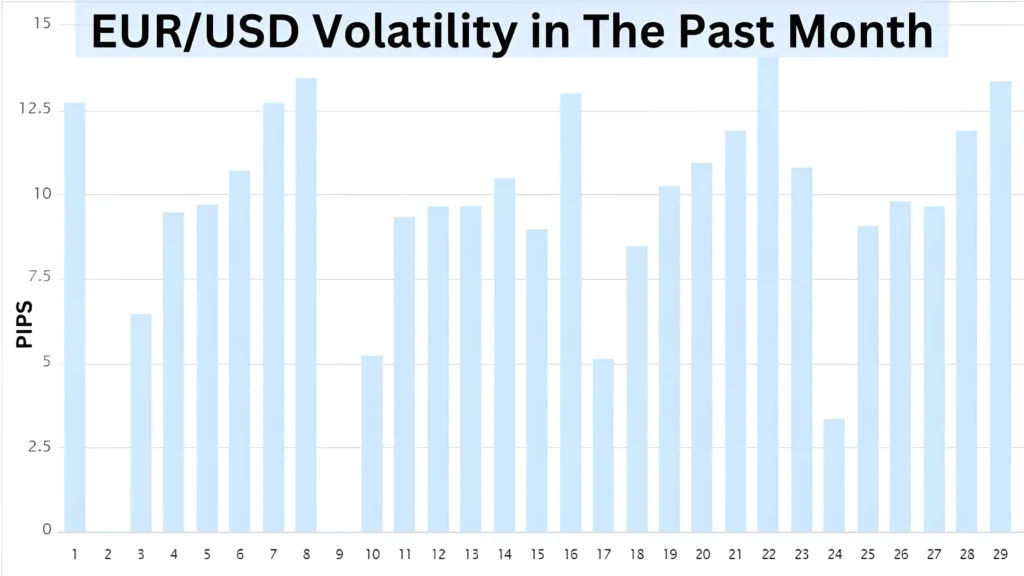

The immense liquidity provided by over $650 billion in daily average turnover makes EUR/USD highly conducive for Day Trading. As the world’s most traded currency pair, it experiences very fast and often violent intraday price swings in response to macroeconomic data and geopolitical surprises. This facilitates many opportunities each session to profit from short-term bounces and reversals typically ranging from a few pips to a few hundred. EUR/USD’s resilience during market turmoil also sustains day traders with reliable price action even in adverse conditions. Overall, its depth and sensitivity render it a viable candidate.

What Are Some Common Day Trading Strategies For EUR/USD?

Successful day traders rely on defined methods to consistently enter and exit the market. Two widely used strategies involve breakout trading and range trading. Breakout traders watch for decisive penetrations of key technical levels as signals to ride emergent momentum in that direction. Others prefer range strategies, going long at supports and short at resistances to profit from intraday consolidations. Still more sophisticated traders exploit order flow via market structure, order book scanning, or volume-based signals. Properly backtested on historical EUR/USD data, such strategies can significantly boost intraday returns when accompanied by strict risk controls.

What Tools Do Day Traders Use For Technical Analysis Of EUR/USD?

Technical indicators help identify potential areas for entries and exits when Day Trading EUR/USD. Common tools involve simple and exponential moving averages to spot potential crossovers that foreshadow accelerating trends. MACD, RSI, and stochastic oscillators signal overbought or oversold conditions conducive to retracements. Fibonacci ratios and trendlines delineate logical reaction highs or lows. Chart patterns like flags, pennants, and ascending/descending triangles project targets on breakdowns or breakouts. Combining multiple inputs increases the confirmation of genuine opportunities worth trading on smaller timeframes.

What Are Some Risks Of Day Trading EUR/USD?

While substantial intraday liquidity lubricates day trading, low timeframe strategies applied to such a volatile major carry considerable risks requiring management. Excessive leverage increases the risk of margin calls, and emotional judgment decreases consistency. News events can abruptly flip markets, invalidating technical assumptions at inopportune times. Commissions and slippage also consume profits on rapid reversal plays. Conservatively sizing positions and employing rigorous risk controls like stop losses restricts the chances of ruinous losses compounding against day traders. Still, it remains a high-risk venture even for the most adept speculators.

How Can Traders Mitigate the Risks Of Day Trading EUR/USD?

While seeking high short-term gains from this liquid pair’s responsive price swings, traders must deploy defensive strategies to reduce the risk of ruin. Alongside hard stops, position size limitations relative to account equity and maximum daily/weekly loss caps shield capital. Monitoring margin levels avoids liquidation risks as buffers narrow. Automating exit triggers removes emotional clouding at critical junctures. Diversifying across multiple-day trading strategies and currency pairs averages risks from any one approach. Finally, discretionary traders must judiciously evaluate whether temperament suits constant exposure and high-pressure environments that day trading EUR/USD perpetually presents.

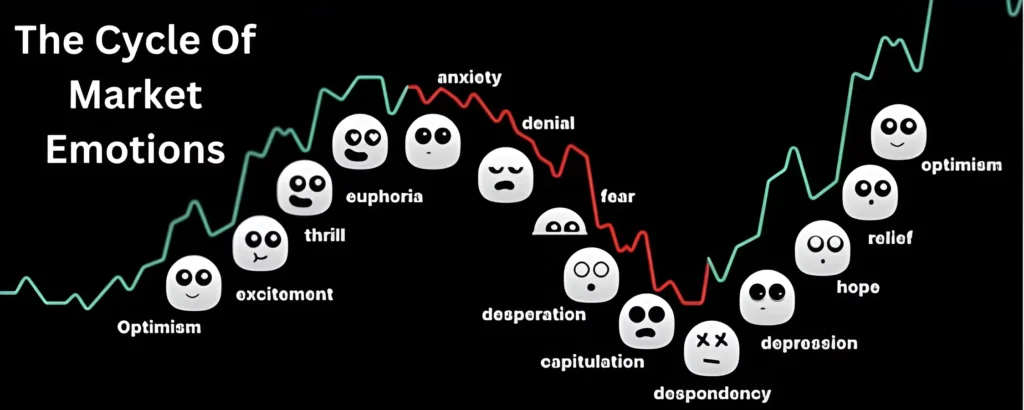

How Important Is Psychology When Day Trading EUR/USD?

Psychology represents perhaps the biggest hurdle day traders face, as intraday volatility whips emotions and clouds judgment. Losses feel amplified on small timeframes yet gains seem minimal. Overconfidence after wins exacerbates this phenomenon, as does revenge trading after losses. Diversifying strategies and portfolio allocations mitigates concentration risks that inflate mental biases. Strict risk management through position sizing communicates a plan’s win rate required to break even, boosting patience. Using demo accounts beforehand and diary-keeping enhances self-awareness around behaviorally-driven tendencies. Adopting risk-defined approaches helps overcome destructive psychology in Day Trading EUR/USD.

What Are Some Alternatives To Day Trading EUR/USD?

Given day trading’s demanding requirements, some pursue other styles using EUR/USD’s leverage. Swing traders hold positions for a few days to weeks, taking some heat out of rapid fluctuations. They still benefit from responsive EUR/USD behavior while allowing technical bets more time to work. Even longer-term traders practice scaling in and out of fundamentally driven positions over months, reducing the stress of minute-by-minute monitoring. Finally, combining EUR/USD day trades with other forex pairs, indexes or commodities dilutes any one market’s risks. Overall, creatively employing EUR/USD’s attributes across timeframes and vehicles expands one’s technical analysis skills while lessening demands of round-the-clock involvement essential for true day trading.

Conclusion

While the immense depth and volatility ingrained in EUR/USD trading presents tremendous day trading opportunities, success requires immense discipline, experience with charts, and an almost professional commitment to risk management. For resilient traders able to withstand sharp intraday movements unemotionalized, Day Trading EUR/USD grants direct access to this exclusive market’s powerful short-term swings. However, others may find modified styles better suited for capably profiting from EUR/USD’s predictive qualities across varying timeframes. Given day trading’s exacting demands, alternative lower-stress applications maximizing this liquid pair remain prudent alternatives.