Position trading allows ambitious investors to surf the mega-swells of the market’s biggest trends. In this article, we’ll uncover the tactics of position traders who time the market like clockwork, hanging on for multisession gains as prices break out to new highs and lows. But it’s not all smooth sailing – we’ll also look at the dangers of getting caught in the chop when trends turn.

What is Position Trading?

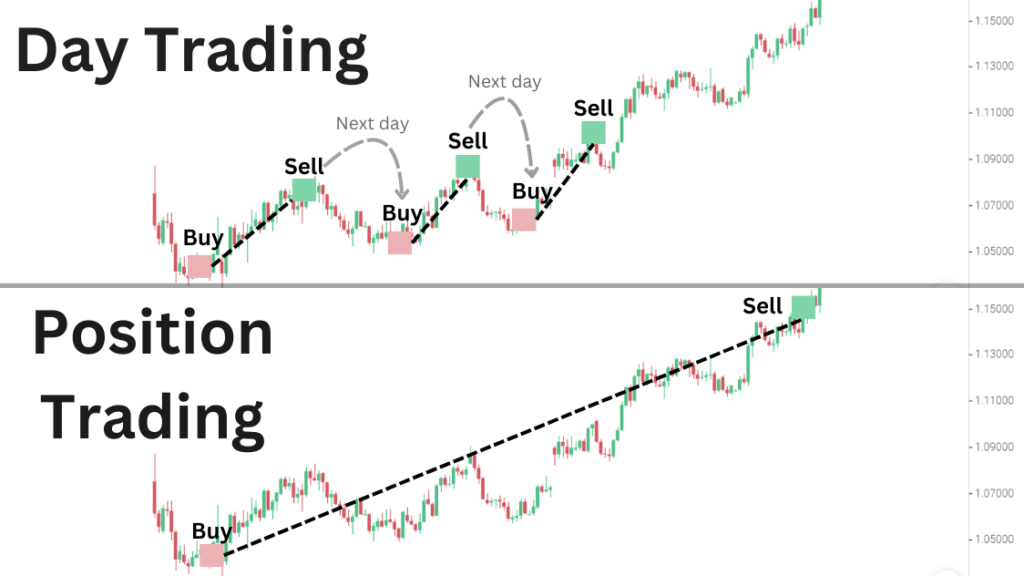

Position trading refers to establishing long or short positions in financial assets that are held for extended periods, ranging from days to months. The goal of position trading is to benefit from identifying intermediate to long-term price trends rather than focusing on short-term fluctuations. Position traders open trades to hold them until price targets or technical indicators signal that underlying trends have changed. This distinguishes position trading from day trading, which involves establishing and closing out intraday positions.

Position traders rely primarily on fundamental and technical analysis to determine attractive entry points for trades aligned with prevailing market trends. Key factors like economic indicators, news events, and chart patterns are analyzed to decide whether to establish long positions in anticipation of price appreciation or short positions to profit from anticipated declines. Patience is crucial, as positions may only be closed out once targets are reached or stop losses are triggered. Overall, position trading aims to profit from medium to long-term price swings rather than short-term volatility.

What Common Position Trading Strategies Are Used?

Swing trading is a popular position trading strategy that focuses on holding positions based on short to intermediate-term price swings, ranging from a few days to several weeks. Swing traders watch for chart patterns like Flags, Pennants, and Triangles that indicate an established short-term trend is nearing its end. They enter on a directional breakout and hold for multiple trading sessions until technical indicators like RSI or MACD signal trend exhaustion or a reversal. Profits are taken not from intraday volatility, but from the continuation of short-term trends.

Buy-and-hold investors also employ a form of position trading, focusing on longer timeframes from months to years. Fundamental analysis of macroeconomic trends and individual company strengths drives the selection of assets deemed undervalued or with strong long-term growth potential. Buy-and-hold traders tolerate short-term volatility in anticipation of sizeable profits from price appreciation over the lifespan of investments. They rely less on charts and more on research supporting assets’ long-term prospects.

Position traders may also implement trend-following strategies using indicators like moving averages to determine entry points aligned with emerging trends. Rather than speculating on reversals, they trade in the direction of prevailing medium or long-term market biases. This form of position trading tends to deliver steady gains by benefitting from the continuation of trends once confirmed.

How Can Technical Analysis Support Position Trades?

Numerous technical tools provide position traders with objective means to determine entry and exit points aligned with intermediate and long-term price behavior. Moving averages identify directional biases when short-term averages cross above or below long-term averages. Crossovers signal potential trend changes, allowing traders to position beforehand. Moving average envelopes define upper and lower thresholds for consolidating price ranges.

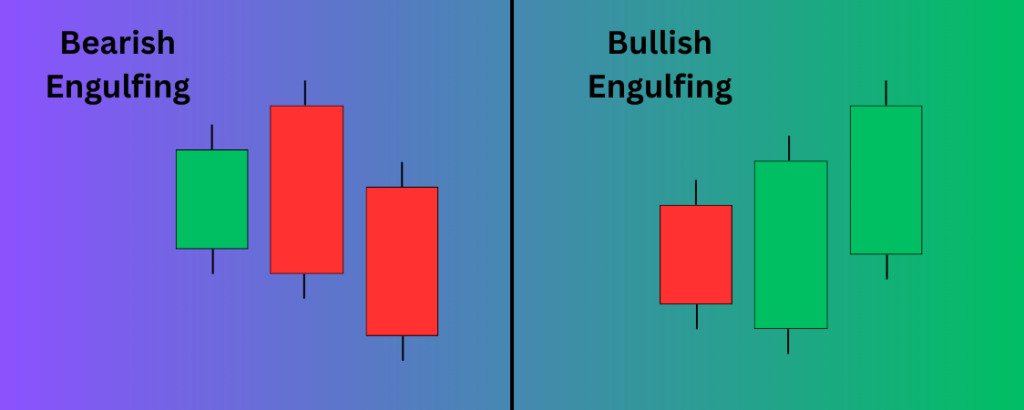

Bollinger Bands contracts during trends and expand during consolidations. Contraction or expansion breakouts point to follow-through potential for in-place trends or nascent trend changes. Candlestick patterns like Engulfing Candles or Hammer/Hanging Man signal short-term sentiment shifts. Alignment of multiple indicators adds confidence in emerging trends or their pending exhaustion, supporting well-timed position entries and exits.

Fibonacci retracement levels provide targets for projecting potential pullbacks within prevailing trends. Successful retests at support levels like 38.2% or 50% Fib levels signal trend resumption, allowing re-entries. Chart patterns like Flag and Pennant formations also signal impending breakouts for swing positions aligned with overarching biases. Combining nuanced technical clues enhances identifying optimal trade setups with the lowest risks.

How Are Position Trades Managed for Risk Control?

Position traders implement various techniques managing trade risks given inherent volatility even during intermediate to long-term trends. Defensive stops placed below recent lows or moving averages protect profits without being stopped prematurely by predictable retracements. Trailing stops drag protective barriers higher as trends progress, securing gains while riding trends longer term.

Partial profit-taking along the way removes initial capital risk while letting profits run. Pyramiding entails adding cautiously to winning positions near support areas. Scaling out evenly as prices rise prevents becoming fully exposed at tops. Setting predefined profit targets guards against giving back gains irrationally once price objectives are achieved. Management also adjusts position sizes based on volatility, concentrating more capital on stable trends and less during choppy periods.

Dollar-cost averaging strategies average down costs on well-researched investments pulled back significantly short term. Risk profile assessment considers technical support strength, fundamentals, and macro factors impacting chosen assets before overcommitting. Overall, disciplined risk controls sustain participation in intermediate to long-term price moves by prudently navigating volatility along the way.

What Are Some Pros of Position Trading?

The potential for sizeable rewards exists with position trading as intermediate and long-term price trends often involve large swings amplifying the impacts of well-timed trades. Participating in extensions of prevailing trends carries less risk versus speculating reversals intraday or short-term. Buying dips and selling rallies allows for capturing a good portion of trends’ profitable ranges. Fundamental underpinnings supporting trades minimize reliance on technical factors alone compared to short-term approaches.

Transaction costs as a percentage of positions diminish greatly relative to day trading due to fewer trades. Margin requirements tend to be lower than for short-term positions as well. Psychological stresses subside versus tracking many intraday fluctuations. Independence from short covering patterns or algorithmic flows benefits certain traders’ temperaments. Overall position trading taps into a sizeable pool of incremental wealth accumulation from longer-term price behavior.

What Are Some Cons to Consider?

Position traders face the risk of losses amplifying during adverse trend reversals given the concentration of capital in fewer trades. Extended holding periods also carry opportunity costs by remaining on the sidelines when trends are unclear. Fundamental or technical analysis may fail to detect longer-cycle turning points. Unexpected macro shocks can disrupt painstaking research, necessitating increased stop adjustments.

Short-term price fluctuations may test patience and discipline before trends reassert themselves. Investing larger portions of capital requires stronger nerves in handling volatility. Taxes tend to be higher realizing more gains each year versus buy-and-hold counterparts. Leveraged positions exacerbate drawdowns during trend contractions as well. Costly mistakes from investing before confirmation signals also impact performance. Position trading profits potentially trail sharply rising bull markets as missing early moves can be costly. Overall success depends heavily on experience, money management acumen, and emotional control.

How Can Traders Evaluate Position Trading Effectiveness?

Several metrics help determine position trading system efficacy. Total net profit figures indicate whether approaches consistently profit after accounting for all commissions and slippage. Average rates of profitability examine cumulative returns compared to buy-and-hold global indexes. Risk-adjusted performance metrics like the Sharpe or Sortino Ratios refine comparisons by incorporating downside volatility risks. Profits factoring monthly compounding show steady, stable wealth accumulation potential matching savings vehicles.

Drawdown figures measure maximum portfolio declines from highwater marks before new peaks are reached. Small and infrequent drawdowns correlate to resilience during corrections. Win/loss ratios exceeding 2:1 demonstrate favorable risk-reward profiles. Annualized returns factoring all time in the market emphasize compounding gains over long periods. Transaction and portfolio turnover rates substantiate the “buy-and-hold” nature relative to short-term approaches. Ongoing journaling and performance reviews pinpoint adjustments improving performance over time as well. Tracking multiple statistical and economic indicators comprehensively assesses true position trading feasibility and potential as an investment or trading vehicle.

What are Sources of Trading Ideas for Positions?

Numerous resources supply trade ideas driving position entries and exits aligned with market behavior. Fundamental analysts uncover emerging macroeconomic and company-specific trends through rigorous scrutiny of annual reports, industry developments, and governance issues. Their actionable insights identify longer-term opportunities. Macro analysts dissect changing monetary and fiscal policies for discerning global capital flow rotations between asset classes and regions over cycles.

Investment newsletters, expert commentaries, conferences, and seminars disseminate professionals’ academic-quality research and interpretations across asset classes and markets worldwide. Brokers also supply quantitative data and automated trading algorithms detecting statistically abnormal price patterns flagging low-risk, high-probability trade candidates. Social media networking exposes a universe of experienced position traders’ methodologies worth investigating for transferable concepts. Ultimately verifying multiple independent research sources strengthens confirming quality position trade factors before deployment of capital long-term.

Conclusion

In conclusion, position trading involves establishing long or short holdings for medium to long durations suited for investors comfortable tolerating swings yet wanting differentiated wealth outcomes relative to buy-and-hold. Substantial rewards materialize by participating in price trend unfoldments aided by alignment of fundamental analysis and technical acumen. Ongoing self-evaluation continues sharpening proficiency with one of investing’s most disciplined approaches over generations.